Our Georgia-based health law firm advises and represents non-physician owners desiring to establish a Management Services Organization (MSO) for the purposes of medical practice. We are an AV-rated highly specialized boutique firm exclusively focused on representing healthcare business owners and medical professionals.

We often advise and assist our clients in evaluating the MSO option and in setting up MSOs where business, legal and/or compliance circumstances warrant doing so. The MSO can certainly be a useful part of proper ownership structure and, in some instances, essential. However, often an MSO is not necessarily the only or the best way to address a corporate practice of medicine concern or a related business risk.

What Is a Management Services Organization?

An MSO is a non-physician entity that manages an organization. MSOs are primarily utilized as a vehicle through which non-physicians can legally own an entity that supplies administrative and business support to a medical practice’s operations. MSOs can also be used to provide an additional revenue stream for physicians who are winding down and/or retiring from clinical practice. Generally speaking, MSO structures are used in situations where corporate practice of medicine laws prohibit non-physician ownership in a medical practice.

The MSO option has been around for many years and, in general, is a tried and tested corporate tool. Due to the evolving landscape of corporate practice of medicine principles from state to state, proper utilization of an MSO in many circumstances involves nuance and significant complexities. Typically, a variety of legal documents must be prepared, negotiated and finalized to properly structure an MSO that is compliant and serves the intended objectives of the owner.

The Anatomy of an MSO

There are few medical practice-related subjects about which we observe more misperception than the subject of MSOs. MSOs (and one of the principal legal documents involved, an “MSA,” or Management Services Agreement) are often perceived to be an easy fix for corporate practice of medicine concerns based on non-physician ownership. Many non-physician owners of healthcare services businesses think that due to corporate practice of medicine laws, one must have an MSO, one must have a physician own 51% (or some other random percentage), or must do this, or must do that. The threshold issue is always, however, is an MSO needed and, if so, for what objective(s)? Where an MSO is actually needed, the action of properly setting up an MSO is not as simple as preparing an MSA. On the contrary, in many instances, setting up an MSO is significantly more involved than that and involves numerous legal documents.

Do I need an MSO?

There are many incorrect assumptions in the esoteric world of health law. One is that an MSO is required wherever non-physician ownership of a healthcare services business or medical practice is involved. While an MSO may be required in some jurisdictions under certain fact scenarios, non-physician ownership will not necessarily equate to a requirement for an MSO. On the other hand, even where an MSO is not required, there may be many advantages, including regulatory protections, by utilizing a properly organized MSO arrangement. Whether an MSO is advisable and what the details of an MSO (if utilized) should be, can be determined by your health law attorney.

In each instance, your healthcare attorney will likely evaluate the details of applicable state law to determine whether an MSO is required or warranted. Often, your counsel may consider what is often referred to as the “Corporate Practice of Medicine” (CPOM) rules or doctrine in the state where the business is organized. If the business delivers healthcare services in more than one state, your counsel may be called upon to evaluate the CPOM rules in each state where such services are delivered. CPOM generally refers to the well-settled principle and objective of ensuring that no business arrangement or contract is such that it would interfere with the clinical judgment of a doctor, including by financial incentives that may lead to overutilization of healthcare services that are not medically necessary.

How this principle is embodied in state law varies (to a degree) from state to state. A common misperception is that CPOM “rules” are always an all or nothing proposition. In some states, however, while there may not be a strict CPOM statute that renders non-physician ownership of a medical practice unlawful, there may be multiple statutory provisions or regulatory pronouncements with CPOM principles embedded in them. Navigating the nuance of such rules and laws can be tricky and should be done by your personal healthcare attorney.

When is an MSO needed in connection with a medical practice?

A high-level answer is that there are two common scenarios where an MSO is helpful in the context of a medical practice:

- When state law (namely, a state’s corporate practice of medicine statutes, rules or principles) requires or warrants an MSO (most often, when non-physician ownership is in play); and

- When a physician is retiring (or approaching retirement) and, rather than selling his or her medical practice, the physician wants to continue the practice but off-load business management for various reasons.

What limitations are involved in setting up an MSO?

While there are many details and limitations that may apply, there are two categories such limitations fall under.

- The specific rules of a state’s corporate practice of medicine doctrine.

We see that it is very common for parties to improperly think of the concept of corporate practice of medicine as a straightforward, up or down, all-or-nothing proposition. They perceive that either they can or they cannot do “X” and that the answer is found in a corporate practice of medicine rule. There is some black and white to be found in this area of law; but often there is more gray than black and white. It is important, therefore, that your healthcare attorney properly research applicable state law, develop an understanding of the inevitable nuance in applying the law to specific facts, and determine how to proceed with given facts, the rules and a desired business objective. There is always a best way to proceed, but it may not be straightforward or simple.

- The risk tolerance of the parties involved.

An appreciation of all significant compliance and business risks involved in an MSO (or of not using an MSO and instead pursuing another corporate arrangement) should always be carefully sought. Each person or organization tends to have a particular level of risk tolerance in conducting business. The importance of compliance should never be discounted for anyone, however. In any event, one’s individual risk tolerance can be a crucial aspect of deciding on what form of structure is “best,” not only in deciding whether to use an MSO at all, but in deciding upon numerous details involved in properly setting up an MSO.

What processes and documents does an MSO involve besides an MSA?

A very common misperception is that an MSO is based on nothing other than an MSA. It is true that an MSA provides an important function and role in a proper MSO arrangement, but the MSA is only one piece of the puzzle that needs to be sorted out and often negotiated among the MSO owners and the physician owner of the medical practice. The following is a partial list of elements or documents often needed to properly structure an MSO that is proper and safe from a compliance, legal and business standpoint.

- MSO Formation Documents and Initial Operating Agreement. The parties create a new limited liability company by filing the appropriate formation documents with the Secretary of State. Typically, a single-member operating agreement is prepared documenting the practice owner(s) as the initial member(s). Various corporate documents are created and filed. The MSO obtains an EIN.

- Holdco Formation. Depending upon certain corporate details concerning how the physician practice is already set up, a holding company may need to be created to minimize adverse tax consequences (that could occur when the non-clinical assets are transferred to the MSO) by utilizing what is referred to as a “F Reorg/Q-Sub election.” In this scenario, the practice owners create a new “Holdco” entity by filing the appropriate formation documents with the Secretary of State. An initial single-shareholder agreement is prepared documenting the practice owner(s) as the initial member(s). An EIN is obtained for Holdco.

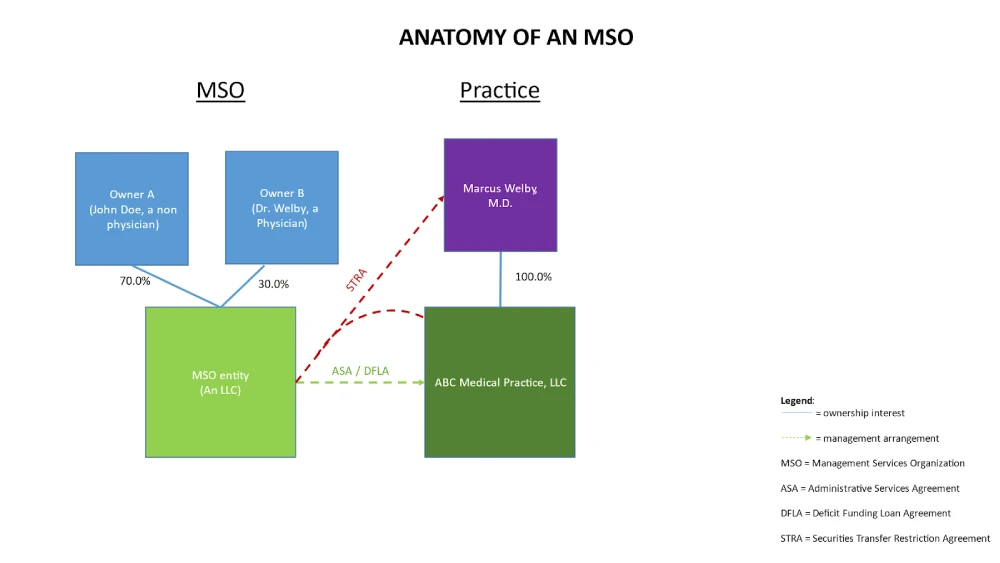

- Contribution Agreement. The physician owner(s) transfers equity in practice to newly formed holding company in exchange for equity therein, makes Q-sub election for Practice. The practice distributes non-clinical assets to Holdco, and Holdco transfers such assets to MSO, which enters into an Administrative Services Agreement with Practice. The physician owner(s) buys stock of Practice from Holdco for nominal consideration, and enters into a Securities Transfer Restriction Agreement with the MSO. The practice reverts to a C-corporation for tax purposes.

- Administrative Services Agreement (a/k/a “Management Agreement”). This important agreement sets out all management services to be performed by MSO on behalf of the practice. The MSO manages the business aspects of the arrangement and receives the practice revenue via a lock box and pays the bills; the net revenue from the arrangement is then distributed to the MSO owners based upon their respective ownership percentage. The distributions, based on net revenue, may change each month.

- Membership Interest Purchase Agreement (MIPA). This is a purchase agreement whereby non-physician owner(s) purchase equity in newly formed MSO from physicians and thereby become owners of non-clinical assets.

- Deficit Funding Loan Agreement. MSO is funding expenses of practice while the MSO waits for reimbursement revenue to arrive; this document provides that on a daily basis the MSO is loaning the practice money to pay its bills and the practice is promising to pay it back.

- Put/Call Agreement. When the physician wants to leave the arrangement, this agreement provides a pathway for the physician’s exit; physician will at certain points have a put right to require the non-healthcare entity to buy the physician out, under specified circumstances; there is a corresponding call right where the non-healthcare entity can require the physician to sell, under specific circumstances.

- Securities Transfer Restriction Agreement. Even though the doctor owns the practice 100%, the doctor cannot sell the practice or transfer anything out of it and can be replaced by the MSO.

- Employment Agreement. The doctor’s obligations to the practice are memorialized in a physician employment agreement. The MSO is a third party to the agreement so that the physician cannot change the employment agreement unilaterally.

- Assignment and Assumption Agreement. This is an agreement whereby the medical practice assigns membership interests in MSO to a buyer as part of MIPA.

- Amended and Restated Operating Agreement. The MSO’s operating agreement should be amended and restated to account for multiparty ownership and a variety of issues negotiated and memorialized.

Though there are variations of a properly set up MSO, an example MSO structure is diagrammed as follows:

Not every MSO is structured the same way. A cookie cutter approach does not work for proper MSO set up. Some MSOs are more involved than others. The above notes describe one example. It is important to consult with your healthcare attorney about proper set up of an MSO.

Our Georgia-Based Health Law Firm

Little Health Law is an AV-rated law firm dedicated to exclusively representing healthcare providers. Our health law firm is based in Georgia but, as a multi-jurisdictional practice, provides assistance to providers throughout the United States in accordance with applicable rules. We are happy to discuss your potential need to set up an MSO. To schedule a confidential consultation, email us at info@littlehealthlaw.com, call our Atlanta office (404.685.1662) or our Augusta office (706.722.7886), or contact us online. We look forward to speaking with you.